refinance transfer taxes florida

This is made possible through the Section 2056 of the Internal Revenue Code IRC also known as the marital deduction rule. For example a 30-year fixed-rate loan has a term of 30 years.

Transfer Tax And Documentary Stamp Tax Florida

Truist which was born from the SunTrust Mortgage Banks Inc.

. But if you go above that threshold for a particular person you begin to reduce your lifetime gift and estate tax exemption of 117 million as of 2021 or 1206 million as of 2022. An Adjustable-rate mortgage ARM is a mortgage in which your interest rate and monthly payments may change periodically during the life of the loan based. This means the IRS wont level federal estate taxes on those assets.

In exchange the lender agrees to forgive the amount left on your loan. When you take a deed in lieu agreement you transfer your homes deed to your lender voluntarily. So feel free to transfer gifts valued in this amount to any number of individuals each without worrying about taxes.

Merger in 2019 gives customers the opportunity to refinance their mortgage via rate-and-term and cash-out refinance. Youre buying the least amount of protection of any deed. A Fixed-rate mortgage is a home loan with a fixed interest rate for the entire term of the loan.

The Loan term is the period of time during which a loan must be repaid. A deed in lieu agreement wont stay on your credit report if a foreclosure will. Also called a non-warranty deed a quitclaim deed conveys whatever interest the grantor currently has in the property if any.

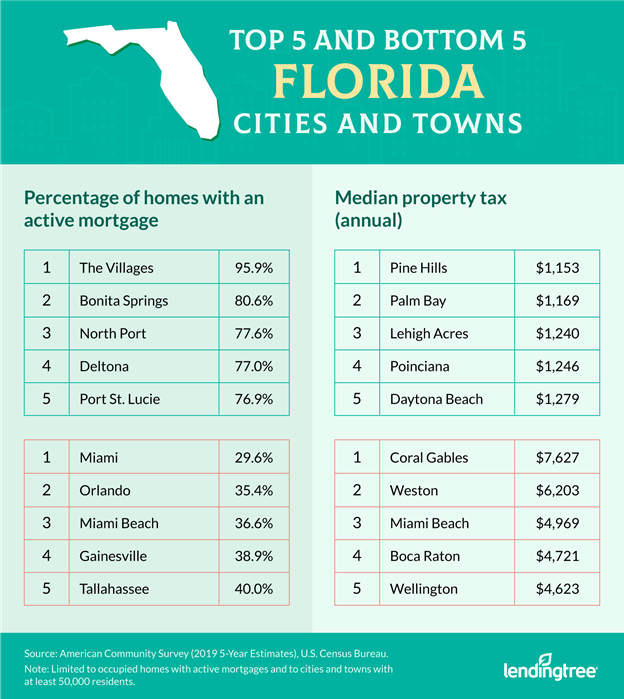

Upon the death of the trust grantor trust assets pass on to the surviving spouse tax free. Other things to know about Florida state taxes. Florida is one of the few states that does not collect income taxes.

A deed in lieu agreement might help you move out of your home and avoid foreclosure. Real estate transfer taxes are considered part of the. So neither spouse owes taxes on the transfer.

Real estate transfer taxes are different from property tax estate tax and gift tax. However its state and local tax burden of 89 percent ranks it 34th nationally.

Florida Intangible Tax And Transfer Tax How Do You Calculate These Closing Costs Usda Loan Pro

Transfer Tax And Documentary Stamp Tax Florida

Smart Escrow For Reps Florida Homestead Check

What Are Real Estate Transfer Taxes Forbes Advisor

Florida Intangible Tax And Transfer Tax How Do You Calculate These Closing Costs Usda Loan Pro

What Is Included In Closing Costs In Florida Mjs Financial Llc

A Complete Guide To Real Estate And Property Taxes In Florida

Refinance Closing Costs Remain At Less Than 1 Of Loan Amount In 2021 Corelogic S Closingcorp Reports

When Is A Property Sale Subject To Documentary Stamp Tax

Nyc Nys Seller Transfer Tax Of 1 4 To 2 075 Hauseit

Transfer Tax In A Refinance Transaction Property Legal Counsel

Mortgage Rates In Florida Plus Stats

Transfer Tax In A Refinance Transaction Property Legal Counsel

What Is A Homestead Exemption And How Does It Work Lendingtree

Florida State Taxes 2021 2022 Income And Sales Tax Rates Bankrate

Nyc Nys Seller Transfer Tax Of 1 4 To 2 075 Hauseit

Florida Title Insurance Refinance Calculator Benefit Title Services